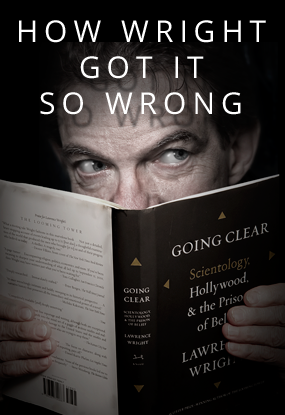

A Correction of the Falsehoods in Lawrence Wright's Book on Scientology

“If the rumors about Hubbard were true—that he created a religion only in order to get rich—he had long since accomplished that goal.

One of his disaffected lieutenants later claimed that Hubbard had admitted to ‘an insatiable lust for power and money.’ He hectored his adherents on this subject. ‘MAKE MONEY,’ he demanded in a 1972 policy letter. ‘MAKE MORE MONEY. MAKE OTHERS PRODUCE SO AS TO MAKE MONEY.’”>> True Information: This is a misinterpretation of a policy letter concerning how to administer the finances of any organization. The “disaffected lieutenant” was David Mayo, cited in a 1987 unauthorized biography of L. Ron Hubbard.

The policy letter is directed to the positions responsible for the financial governance of Scientology Churches, whose function is to ensure the financial well being of their Church. So while it is a basic policy for financial management, taken in the context of who it is addressed to as to function, and the fact that it is one of over 10,000 policies and bulletins written by Mr. Hubbard, it should be clear that this is not the major overriding purpose and policy of the Church.

L. Ron Hubbard operated for the furtherance of the religion he founded. Exemplifying this is that he donated his estate to the furtherance of the religion he founded. Examining what the Church has done with the funds it raises shows further that the entire purpose is to further the charitable purposes of the religion.

This was a critical issue addressed by the United States Internal Revenue Service before ruling in 1993 that the Church and its related organizations were tax exempt. The IRS reached the conclusion that no funds are expended for the advantage of any Church leader or individual and that the Church serves “exclusively religious and charitable purposes.”

A portion of the contributions received by Churches of Scientology from parishioners goes to the Church of Scientology International (CSI) to fund projects and activities to benefit the entire Church of Scientology hierarchy. This includes the production of books, recorded materials and films, property purchases and property improvements necessary to expand Church programs and operational expenses for ecclesiastical management and support. These monies also contribute toward the Church’s extensive social betterment and social reform activities.

In addition to fixed donations for services, Churches of Scientology and the religion’s international membership association raise additional funding that provides for the opening of new Churches and the implementation of large-scale social programs around the world. A great number of international Church programs, especially in the fields of drug education and rehabilitation, raising literacy standards and advancing human rights, are funded by grants from the International Association of Scientologists (IAS), which raises donations from its members without regard to their participation in any services. Scientologists contribute because they wish to support the religion, its ministry and the Church’s many social betterment programs that benefit society as a whole.

Courts examining the issue have determined that the method of fundraising used by Scientology Churches is not dissimilar in substance to fundraising practices of other religions.

For example, many religions request that members tithe a certain portion of their income. 10% is considered the minimal benchmark that Christians should pay to their Church. While this is the amount dictated by the Old Testament for the Levites, it is still considered that if one “is spending more than 90% of our income on ourselves, it may be evidence that our priorities aren’t right”.

One Christian website states: “If I choose to tithe, does God expect more than a tithe from me?” and the answer given is: “For most Christians the answer is a resounding ‘yes’. The Old Testament sets forth a system of tithes (10 percent offerings). For this reason many Christians conclude that by giving 10 percent they fulfill God’s requirement and are absolved or further responsibility. But interestingly, the tithe is mentioned only rarely in the New Testament, not because God expects less from the majority of us, but because far more is possible, particularly given the fact that the Old Testament actually speaks of three tithes totaling 23.3 percent of agricultural income. ..”

Christians often donate a “second tithe”. The tithe is the ten percent paid, the additional contributions are known as “offerings”: “In addition to returning a faithful tithe, members are encouraged to support various foreign mission projects as well as provide revenue for local church ministries. Funds are also required to maintain the church equipment and facilities. When a high percentage of church members contribute an amount equal to a second tithe, both the local church and the mission outreach programs are usually able to fulfill their respective objectives.”

The tithe paid by members of the Mormon Church is 10% of the person’s income.

While Jews do not tithe, they pay for a Patron system. Some synagogues set the “suggested dues” for families earning more than $250,000 at $6,000 a year – and in addition they require a range of payments to help defray expenses for special programs, school tuition, building funds, as well as membership fees for Jewish Community Centers. Then there is the fact that kosher food can cost up to 50% more than average food. Above and beyond these essentials for Jewish living are contributions in support of charities such as the local federation of Jewish philanthropy, Jewish educational institutions and funds for Israeli institutions which many Jews contribute to.

In Islam, “Zakat” or “alms giving” is one of the Five Pillars of Islam. Zakat is payable on different kinds of assets: accumulated wealth beyond one’s personal needs (2.5%); production (agricultural, industrial, renting etc.) between 5% and 10% is paid, and for any earnings which require no labor or capital (such as finding treasure) then 20% is paid. A high level of importance is placed on paying “Zakat” and it is considered a means to purify oneself from greed and selfishness and safeguarding future business.